By Nur Iman Eirfan

Abstract

It is inevitable that we are moving towards the digitalization era whereby most of our daily transactions will be done virtually. Hence, the emergence of new-digitalised transactions such as online banking transactions have made the concept of ‘Buy Now, Pay Later’ more popular and in demand more than ever. This article aims to find, understand and analyse the relationship between the concept of ‘Buy Now, Pay Later’ as a transaction method in daily usage and the Maqasid al-Shari’ah – specifically under the Protection of Wealth (Maqsad Hifz al-Mal). With the emergence of Buy Now, Pay Later, there are several shari’ah issues that riddle and concern the consumers specifically on the possibility of BNPL as a mainstream method in processing transactions and the position of BNPL in Malaysia. This article will further discuss the concept of Buy Now, Pay Later especially in analysing its’ performance and risk issues.

Keywords: Buy Now, Pay Later (BNPL), Maqasid al-Shari’ah, Protection of Wealth

Abstrak

Tidak dapat dielakkan bahawa dunia sedang menuju ke era pendigitalan di mana kebanyakan transaksi harian kita akan dilakukan secara maya. Justeru, kemunculan transaksi digital baharu seperti transaksi perbankan dalam talian telah menjadikan konsep ‘Buy Now, Pay Later’ lebih popular dan mendapat permintaan lebih tinggi daripada sebelumnya. Artikel ini bertujuan untuk mencari, memahami dan menganalisis hubungan antara konsep ‘Beli Sekarang, Bayar Kemudian’ sebagai kaedah transaksi dalam penggunaan harian dan Maqasid al-Shari’ah – khususnya di bawah Perlindungan Harta (Maqsad Hifz al-Mal). Dengan kemunculan ‘Beli Sekarang, Bayar Kemudian’, terdapat beberapa isu syariah yang menjadi teka-teki dan kebimbangan para pengguna khususnya mengenai kemungkinan BNPL sebagai kaedah arus perdana dalam memproses transaksi dan kedudukan BNPL di Malaysia. Artikel ini akan membincangkan dengan lebih lanjut tentang konsep Beli Sekarang, Bayar Kemudian terutamanya dalam menganalisis prestasi dan isu risikonya.

Kata kunci: Buy Now, Pay Later (BNPL), Maqasid al-Shari’ah, Perlindungan Harta

1.0 Introduction

“Buy Now, Pay Later” (later as “BNPL”) is a form of point-of-sale financing. With BNPL financing, the consumer can buy goods and services instantly and pay for them later according to an agreed payment schedule. BNPL finance is more often offered online and has generally been developed by technology-focused non-bank financial firms, often described as “Fintech” firms.1

BNPL has seen rapid growth in recent years. Reports indicate that BNPL funding may have tripled in 2020 compared to the previous year. The consulting firm estimates that BNPL balances grew 24% from 2016 to 2019 and is expected to grow about 20% annually over the next three years.2 The increased use of BNPL, due to its convenience, which is similar to consumer credit, has occurred for many reasons. With the advancement of technology, consumers may switch to cashless transactions and will not need to physically carry cash, thus reducing the risk of theft or loss and the inconvenience of running out of cash.

2.0 Buy Now, Pay Later (BNPL): An Overview

The concept of BNPL, which was introduced as a personal finance product, allows consumers to delay or even make staggered (instalment) payments when purchasing a product or services. This type of service is also known as a form of short-term financing that allows consumers to make purchases and pay for the purchases at a later time or at a future date.3 This flexible credit option has received attention and gained mass popularity in the United Kingdom, Europe, the United States and other markets globally.4

It is crucial to point out that five million people in the United Kingdom have started to use BNPL in the past years, which amounts to 2.7 billion users.5 However, the reception in Malaysia is not as superfluous as Bank Negara Malaysia (BNM), being the financial regulator of the nation, has raised legitimate concerns with BNPL, as consumers are allowed to spend beyond their means and may end up with excessive debt.6

2.1 The Concept of Buy Now, Pay Later

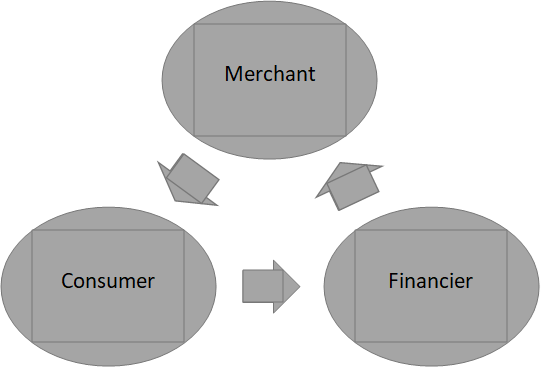

BNPL is an arrangement that allows consumers to pay for goods over time while receiving such goods as if the payment was made upfront.7 BNPL can be defined as an arrangement between three parties which consists of the consumer, financier and merchant. Generally, the method would be (1) the consumer will buy and receive either goods or services from the merchant where (2) the financier pays the merchant for the consumer’s purchase and (3) the consumer will repay the financier for their purchase overtime, staggery.8

Figure 1: General transaction structure of BNPL

The general application of Buy Now, Pay Later would be that the consumer purchases goods or services through a particular retailer, which the consumer then chooses to pay via any BNPL platform. Typically, the consumer9 shall be asked to pay for a down payment for the first month’s instalment. Then the rest of the payment shall be made throughout the monthly instalments.

But it is worth noting that each company has its own terms and conditions on the application of BNPL. For example, some company imposes to pay 25% of the overall payment of purchase amount and the instalment payment shall be made through bank transfer, cheque, or even direct deduction from the consumer’s bank account10. There are even some companies that prefer to automatically deduct the balance from the consumer’s credit cards. Nonetheless, at the end of the day, the terms and conditions imposed on the consumers shall be based on the company’s policy11. Some financiers allow BNPL financing with the ability of allowing the consumers to pay the instalments in four stages.12

2.2 Availability of Buy Now, Pay Later in Malaysia

Buy Now, Pay Later is fast emerging as a popular payment method in the e-commerce space in Asia, and Malaysia is catching on to the trend. It is further contended that the growth of BNPL method has increased with the rise of e-commerce especially during the Movement Control Order period (MCO),13 as the consumers shifted from physical shopping to online or virtual shopping due to the restrictions.14 This is also due to the closing of numerous physical stores, especially those that were not within the category allowed to be open by the government, thus, accelerating the uptake of BNPL.15

There are several other platforms that are currently available in Malaysia and widely used, inter alia, Atome, FavePay Later, myIOU, PayLater, PayLater by Grab, SPayLater by Shopee and Split.16 For example, Hoolah is one of the most preferred options among consumers with a tremendous growth of 400% consumer expansion and a doubling of repetitive usage.17 Although it is a Singapore-based company established in 2018,18 it is one of the payment methods adopted by local brands, notably the Duck Group.19

Apart from Hoolah, FavePay Later is another one of the widely used payment methods in Malaysia and Singapore with over 40,000 retailers including well-known brands, such as Pandora and Marks & Spencers.20 The Chief Executive Officer of FavePay Later, Joel Neoh, further emphasised that as one of the leading payment apps, the consumers shall be able to earn up to 10% cashback with every purchase made either online or offline.21

Next, is “myIOU” which offers more flexible tenures compared to other BNPL platforms. However, myIOU is only confined to several merchants.22 Besides e-hailing apps, Grab also launched its own BNPL services in 2019, known as PayLater by Grab which is available to all Grab app users. There are two options, (1) the consumers can consolidate all their bills and pay them in a lumpsum in the following month or (2) split the payment by instalments.23

Another popular platform is SPay Later which was introduced by Shopee. Similar to myIOU, there are two options available for the consumers to choose from, the first is where the users will have to pay the full amount of their purchases in the following month, with no fees charged. The second method is to pay via monthly instalments (either 2, 3 or 6 months) with a 1.25% of processing fee on their order for each month.24

The following is a list of BNPL platforms available in Malaysia25:

| No. | Platforms | Period of Tenure (months) | Processing Fee | Late Payment Fee |

| 1 | Atome | 3 | 0% | RM 30 per late payment (max RM 60 per purchase) |

| 2 | FavePay Later | 3 | 0% | 1.5% out of outstanding payable amount per late instalment |

| 3 | myIOU | 2, 3 or 6 | 0% | RM 5 or 1% on outstanding amount per late payment – whichever is higher |

| 4 | Hoolah | 3 | 0% | Rm 7.50 to RM 75 per late payment |

| 5 | PayLater | 4 | 0% | RM 10 for every 7 days of non-payment |

| 6 | PayLater by Grab | 4 | 0% | RM 10 account reactivation fee if paying by instalment (max RM 30 per purchase) |

| 7 | SpayLater by Shopee | 2, 3 or 6 | 1.25% | 1.5% per month on overdue amount |

| 8 | Split | Up to 3 | 0% | RM 0 |

Table 1: BNPL platforms available in Malaysia.

2.3 Differences between Credit Card and Buy Now, Pay Later

Before delving further into the subject of BNPL, it is crucial to differentiate the BNPL services from credit cards as both offer the same services of credit. A credit card can be defined as a thin rectangular piece of plastic or metal issued by a financial institutions or bank, that allows cardholder to borrow funds,26 purchase goods and services on credit.27 Banks and financial institutions impose conditions on the usage of credit cards. According to the Bank Negara Malaysia, a credit card can be defined as a designated payment instrument which indicates a line of credit or financing granted by the issuer to the cardholder and where any amount of the credit utilised by the cardholder has not been settled in full on or before a specified date, the unsettled amount may be subject to interest, profit or other charges. This differs from BNPL which is a facility that is specially designed to let consumers purchase goods or services on instant credit.28

The table provides a brief comparison of the two.

| No. | Matters | Credit Card | Buy Now, Pay Later |

| 1 | Offered by | Bank and Financial Institution | Digital Payment Apps |

| 2 | Interest29 | Yes | Depends on the platform |

| 3 | Convenience | Consumers will need to follow the procedure to apply for credit card and this vary according to each bank | The payment option is already embedded in the apps or consumer will need to apply virtually (online) through the apps |

| 4 | Approval | Takes time | Instantly |

| 5 | Eligibility | Depends on the credit score | Approval given not based on the credit score |

| 6 | Equated Monthly Instalment | Set as per the user | Usually, three months but it depends on the platform |

| 7 | Hidden Charges | Depends on the financial institutions or the banks that issue the credit card | No hidden charges |

Table 2: Differences between Credit Card and BNPL

To conclude, it is noteworthy to bring forth the fact that Credit cards and Buy Now, Pay Later, have their own advantages and disadvantages. With regard to BNPL, it is convenient, and one can say it is a disciplined way to pay for purchases overtime. Most of the BNPL platforms provide zero interest or lower interest than credit cards. As mentioned in the table, it is not necessary to keep a good credit score in order to apply for BNPL and the approval can be obtained within seconds. But one has to note that in the case of missing or late payments, it will result in late fee payment and damage the consumer’s credit score.

The payment option enables the consumers to manage their finances and to avoid increasing the credit card usage and other debts as most BNPL platforms offer interest-free services with no hidden charges.30 It is essential to have control over the spending when the merchants are constantly promoting such tempting offers, as contended by the Bank Negara Malaysia (BNM).31

3.0 Discussion on Maqasid al-Shari’ah: Protection of Wealth

Maqasid al-Shari’ah plays an important role in guiding an individual or even the government that seeks to uphold shari’ah principles. Government policies must not only adhere to shari’ah principles but also serve its objectives such as enjoining good and eliminating evil, prevention of dubious banking transactions and introducing the Islamic framework especially in matters involving wealth. Compliance with Maqasid al-Shari’ah will preserve a government’s aspiration to implement shari’ah values in all its policies.

Allah mentioned through al-Quran that He had sent the people forth but as a herald of good news and a warner for all mankind.32 From this verse, it can be understood that Islam is a complete religion because all actions or deeds made by humans will be judged whether it is good or bad. In short, the virtuous person will be rewarded while the corruptor will be punished.

In ensuring and keeping Islam as a comprehensive religion, there is a guideline in achieving such. Maqasid al-Shari’ah can be understood as the objectives and the rationale of the shari’ah.33 A comprehensive and careful understanding of shari’ah rulings entails an understanding that shari’ah aims at protecting and preserving public interests (maslahah) in all aspects and segments of life.34 In other words, it can be defined as the legal Islamic doctrine in relation to controlling human behaviour which is intended by shari’ah for the realisation of benefit to humankind. It is generally held that Islamic law in all its branches aims at securing benefit for the people and protecting them against corruption and evil.35

Generally, it can be understood under the heading of necessity (daruriyyat), there are five maqasid al-shari’ah, which are protection of religion, life, mind, lineage and property. The Muslim scholars have classified the entire range of maqasid into three categories in the descending order of importance which are the daruriyyat (the essential), the hajiyyat (the complementary) and the tahsiniyyat (the desirable or the embellishments).36

3.1 Definition and classifications of Protection of Wealth (Hifz al-Mal)

Maqasid al-shari’ah is the guiding principle in our daily routine. It applies to everything: laws, conduct, opinions, products, transactions, activities, and services. An individual needs money and property, either for his worldly or religious interests. To protect one’s life, an individual requires the basic needs such as food, drinks, accommodation and clothes that can only be acquired by money.

In Arabic, the word ‘property’ is al-mal, and the plural of the word is al-amwal. The word al-mal originated from the Arabic verb Mala which means tend or incline.37 Al-mal means something that is possessed and controlled (hiyazah) by someone, be it physical (`Ain) or usufruct (manfaah).38 Next, the word al-Mal also carries the meaning of ordinarily all things which are capable of being owned.39

Therefore, based on the definition, it can be summarised that al-Mal can be categorised as something that can be controlled and can be used directly, such as money, houses and others, or something which still can be controlled though not directly but as long as it can be used, such as minerals below the surface of the earth.40

In Islam, it is compulsory to handle wealth in accordance with shari’ah. Wealth is a source of pleasure in life that may be exceedingly distracting if not properly guided as stated in surah al-Kahfi verse 46:

الْمَالُ وَالْبَنُونَ زِينَةُ الْحَيَاةِ الدُّنْيَا ۖ وَالْبَاقِيَاتُ الصَّالِحَاتُ خَيْرٌ عِنْدَ رَبِّكَ ثَوَابًا وَخَيْرٌ أَمَلًا

“Wealth and children are the embellishment of the worldly life, and the everlasting virtues are much better with your Lord (Allah), both in rewards and in creating good hopes.”

The objectives of al-Mal are constructed by observing the essence, utility, and role of wealth in relation to human wellbeing. The two core objectives are to facilitate wellbeing (maslahah) and to prevent harm (mafsadah).41

Besides, among the proposed objectives of al-Mal in Islam are the following: (1) the perpetual investment of wealth, (2) the perpetual circulation of wealth, and (3) fair and transparent financial practices. In regard to the objectives of wealth investment and circulation, it must bring benefit to all people in society. Consequently, the prevention of healthy circulation of wealth would be religiously problematic since Allah mentions in surah al-Hasyr verse 7:

كَىۡ لَا يَكُوۡنَ دُوۡلَةًۢ بَيۡنَ الۡاَغۡنِيَآءِ مِنۡكُ

“So that it may not merely circulate between the rich among you”

Wealth, as well as everything, belongs to Allah. When humans were granted the status of vicegerents on earth, they were commanded to preserve such status and not to waste it. Hence, every transaction must be practised in accordance with shari’ah. The protection of wealth falls under the sphere of necessary matters (daruriyyat) as the abolishment of preservation of wealth would result in the loss and damage of everything that we embrace as valued.42 If the objectives of maqasid al-shari’ah in business transactions are neglected, it may result in poverty and anarchy.

From a financial point of view, one of the most important objectives in shari’ah is elimination of riba in all categories of transactions. There are two main categories of riba, namely riba al-nasiah, which is interest on lent money, and riba al-fadl which is earnings or excess acquired by exchanging or selling commodities of superior value over other commodities given. Islam clearly prohibits riba as seen in al-Baqarah verse 275:

اَلَّذِيْنَ يَأْكُلُوْنَ الرِّبٰوا لَا يَقُوْمُوْنَ اِلَّا كَمَا يَقُوْمُ الَّذِيْ يَتَخَبَّطُهُ الشَّيْطٰنُ مِنَ الْمَسِّۗ ذٰلِكَ بِاَنَّهُمْ قَالُوْٓا اِنَّمَا الْبَيْعُ مِثْلُ الرِّبٰواۘ وَاَحَلَّ اللّٰهُ الْبَيْعَ وَحَرَّمَ الرِّبٰو

“Those who devour usury will not stand except as stand one whom the evil one by His touch hath driven to madness. That is because they say: “Trade is like usury,” but Allah hath permitted trade and forbidden usury (riba)”

Both types of riba’ cause unfairness in any business transactions. It provides an easy way for the rich to expand their wealth by weakening the other members of the community. Looking from the maslahah point of view, riba causes income inequality and lower economic growth as low-income human capital are neglected from upgrading their wealth.

In light of maqasid al-shari’ah, the foundations of Islamic economics are built on the concepts of economic well being, equitable distribution of income, and a just freedom of the individual. Shari’ah does not promote development and growth for the cost of human lives, and hardship in living. Profiteering and material gain must be directed with the aim for the ultimate Falah (Success) in the Hereafter.43 Hence, the preservation of al-Mal as one of the aspects protected under maqasid al-shari’ah must be observed by each and every Muslim.44

4.0 Issues and Challenges of Buy Now, Pay Later

4.1 Performance and Risk Issues on Buy Now, Pay Later

The growing of BNPL services is raising concerns as many consumers45 may be caught in long term debt. The trend of using this payment method has vastly increased worldwide especially during the coronavirus pandemic.46 According to Pine Labs Pte Ltd, one of Asia’s leading merchant commerce platforms and a BNPL provider, even though the usage of BNPL in Malaysia is not as prominent as countries like Singapore and China, it will be expected to increase rapidly over the next few years.47 Nevertheless, as the option itself can offer fast and convenience at the checkout phase, many consumers do not realise that they are actually taking the risk of committing to debt. In other words, the consumers may unintentionally be exposing themselves to many sorts of potential consequences if they fail to pay back on time including late fees, penalties or legal actions by the BNPL provider.

Unlike credit card issuers, the BNPL providers are not required to consider whether the customer is able to repay the loan or not as most of the BNPL providers only perform a mild credit check for interest-free instalment loans. Accordingly, the consumer may use numerous BNPL services in addition to other credit options, putting themselves at risk of financial overstretching.48

Hoolah, for example, is one of the most popular BNPL platforms, with over 400% user growth and doubling of repeat usage in 2020.49 The Singapore-based e-commerce service currently has more than 1,000 merchant stores in Malaysia, including local and international brands in fashion, cosmetics, home supplies and lifestyle.50 The co-founder of Hoolah, Arvin Singh stated that the BNPL can be considered as a preferred payment method especially among the millennial and Gen Z groups.51 Apart from this service being the preferable method of payment, a new study from consumer research firm Piplsay in the United States discovered that although 74% of BNPL users were able to make their BNPL payments on time, another 14% missed a payment once and 12% missed a payment multiple times.52 As some of the BNPL providers impose late payment charges like ShopeePay Later, these additional charges may have an element of usury and it is forbidden according to syarak.53 Therefore, not only will the consumer be exposed to the risk of financial overstretching, but also the customer, especially Muslims will be involved in illegal transactions as usury is a major sin in Islam. This point will be discussed further in shari’ah issues in relation to the use of BNPL.

Another possible risk for consumers is that BNPL could encourage impulse buying. While BNPL services are still in the early stages in Malaysia as there are only a few active providers, it has seen rapid growth in Singapore during the last five years. According to the financial comparison site Finder.com, 38% of Singaporeans or about 1.1 million people have utilised BNPL services.54 According to the survey by Finder, more than a quarter (27%) of Singaporeans aged 16 and above acknowledged being worse off financially as a result of a BNPL mistake.55 The survey indicates that making an impulse purchase is the most common BNPL faux pas with nearly one-fifth of Singaporeans (17%) admitting to doing so. The second most common infraction is purchasing a more expensive item than the customer otherwise would have (15%).56

In addition, BNPL services also expose the customer to a longer-term risk.57 As mentioned before, most millennials and Gen Z groups preferred this method of payment as it is fast and convenient. However, if the trend of late and missed payments is often done by the customer there will be a great consequence. For instance, any financial trouble could make it difficult for them to receive financial loans or credit in the future or even to obtain certain types of employment. As for Malaysians, particularly the younger generation, are piling up debts and risking bankruptcy by relying on banks for loans and credit cards, according to extensive data and statistics. According to the survey conducted by The RinggitPlus Malaysian Financial Literacy in November 2020, it was learned that 53% of Malaysians would be unable to survive for more than three months if they lost their jobs and 46% spend more than they earn. Surprisingly, 76% of them claimed to be in charge of their personal finances.58

Moreover, the World Bank Group in the 21st edition of its Malaysia Economic Monitor, expressed concern about bankruptcy among those aged 25 to 34, connoting that 60% of bankrupt debtors were in this age group.59 Based on the study, millennials spend well beyond their means because of impulse buying behaviour, easy access to personal loans and credit card financing, the desire for instant satisfaction, and continuous online shopping.60 Hence, although there may be several benefits of BNPL, consumers must be aware of the risks which they are exposed to. They also should differentiate on what they need and do not as they might easily go over budget with BNPL services.

4.2 Challenges: Shari’ah Issues on Buy Now, Pay Later

ShopeePay Later or SPay Later is an official BNPL product by Shopee.61 It offers an instalment payment method which can be paid with or without having a credit card. SPay Later is a payment service that allows the consumer to consolidate the purchases on Shopee on a monthly basis or one off-payment on the consolidated outstanding amount at the end of each month.62 There are certain requirements for a consumer to register with SPay Later, for example, one needs to have at least three months usage of a Shopee account with a verified account. Shopee has appointed SeaMoney Capital Malaysia Sdn Bhd to manage Shopee’s instalment payment operations.63

The first issue is with regard to the one-off payment consolidated method within a month. There is no shari’ah issue if the payment is completed within a month as stipulated. On the other hand, if the consumer is late in settling the payment and is charged for late payment, then there will be riba on the late payment which is forbidden by Syarak. The second issue will be on the instalment payment, specifically on the late payment fees and processing fees. As far as the second issue is concerned, both will be tainted with riba transactions since both of the payment, processing and late fees will be higher than the operation cost and the loss will be part of riba.

The SPay Later system involves debt due to the very fact that the Shopee-appointed SeaMoney party (in this context, SeaMoney shall be considered as the financier) will pay the Shopee seller first on behalf of the consumer, then the consumer has to pay to SeaMoney in instalments or one-off within a month. Therefore, consumers are considered indebted to SeaMoney when using this SPay Later service.64 The issue of this transaction will highly revolve around and focus more on usury issues specifically under riba al-Qard that accrue through the instalment payment system. As contended earlier, the issue would be on the processing fee for the instalment payment and the late payment fee.65

With regard to the processing fee, which means additional charges imposed for customers who choose the instalment method of payment offered by Shopee. Customers who choose to pay using the instalment plan will be charged a processing charge of 1.25% per month of the purchase amount.66 No additional charges will be levied if the customer pays one-off within a month.67 The Processing Fee imposed is seen to have an element of usury as it takes advantage of the profits from the loans granted. Which in the case where the SeaMoney paid first the payment on behalf of the consumer to the seller.

Next, is the late payment fee which will be levied on the consumers who fail to make payment within the specified time period for both payment methods, one-off payment and instalment payment. Consumers will be charged an additional 1.5%68 of the outstanding amount on a monthly basis. The late payment fee is seen to have a clear element of usury. This is because any debt that is accompanied by additional payments due to the delay in making payment is included in the category of riba al-Qard. However, if the charge is imposed to cover the cost of loss, then it is allowed provided that the cost is based on the actual cost (actual loss) as compensation (ta’widh) is not considered as a fine (gharamah) or additional income for the financial provider company.69

According to the office of Mufti70, there are shari’ah issues on the processing fees and late payment fees since both of these fees are said to have an element of usury. As for the one-off payment method within a month, there is no shari’ah issue on it because there is no element of usury, and it can be used. However, if the customer pays late and incurs additional charges, then riba al-Qard occurs. It is emphasised that Muslims are prohibited from engaging in any transaction that has an element of riba because riba is haram and a greater sin as written in the al-Quran through surah al-Baqarah verse 275, but God has allowed trade and forbidden usury.

5.0 Discussion and Analysis

The application of shari’ah principles, primarily the al-Quran and Sunnah as well as other Islamic jurisprudence principles such as maslahah or public interest would be the scope of discussion on BNPL service and also from the standpoint of Islamic Law. Maslahah is a consideration of public interest with the purpose to secure advantages and prevent harm.71 According to Al-Ghazali, maslahah is the preservation of the objectives of shari’ah.72 Thus, the objectives of shari’ah comprises of protection of religion (hifz al-din), protection of life (hifz al-nafs), protection of mind (hifz al-‘aql) , protection of lineage (hifz an-nasl) and protection of wealth or property (hifz al-mal). Furthermore, maslahah is divided into three types; whether it is recognized or rejected by the shari’ah and maslahah that is neither recognized nor rejected by the shari’ah. It is crucial to study the term maslahah as it is linked to the formation of modern society, and it has the potential to serve as the required foundation for the fulfilment of human desires.

The shari’ah has contended itself by allowing humans from acquiring wealth through legal means and demonstrating the various aspects of good and evil while spending wealth. The objective is to encourage individuals to spend their money wisely and avoid mismanaging it. Likewise, shari’ah has been content with not depriving individuals of their benefits and gains in which they use it for beneficial purposes.73 Allah stated in al-Quran which means:

“And when you have performed your acts of worship, [continue to] bear God in mind as you would bear your own fathers in mind – nay, with a yet keener remembrance! For there are people who [merely] pray, “O our Sustainer! Give us in this world” – and these shall not partake in the blessings of the life to come. But there are among them those who pray, “O our Sustainer! Grant us good in this world and good in the life to come and keep us safe from suffering through the fire:” it is these that shall have their portion [of happiness] in return for what they have earned. And God is swift in reckoning”.74

As the world is currently moving towards modernization, the Islamic finance industry is no longer unfamiliar among consumers all around the globe. Therefore, the practical role of maqasid al-shari’ah is vastly important to be applied to the reality of modern banking practices. The discussion of maqasid al-shari’ah is frequently included with maslahah as both of these terms are used interchangeably. In this section, we will be concentrating on how the usage of BNPL services relates to the objective of shari’ah particularly on the protection of wealth.

5.1 Applying fiqh muamalat in BNPL: A Framework based on maqsad hifz al-mal

5.1.1 Integrating the context of verse with the actual situation (waqi’)

Islam commands their believers to accumulate wealth in a proper and legitimate means. As stated in al- Quran, “And do not consume one another’s wealth unjustly or send it [in bribery] to the rulers in order that [they might aid] you to consume a portion of the wealth of the people in sin, while you know [it is unlawful]”75 As far as the issue of late payment charge is concerned, this type of penalty is forbidden in Islam as there is an element of riba or usury. In the al-Quran, Allah stated that, “O you who believed, do not consume usury, doubled and multiplied, but fear Allah that you may be successful”.76 Generally, in Islamic finances, banks or issuers are not allowed to impose debtors’ penalty due to late payment as this can be considered as a form of interest. However, the context of this verse reveals that it relates to the scenario between rich lenders and poor borrowers, in which the former takes advantage of the latter’s inability to pay.77

BNPL providers do not act as sole lenders. Instead, BNPL is the arrangement between a consumer, a financier and a merchant, which means through this arrangement there will be three parties involved. Generally, the method would be (1) the consumer will buy and receive either goods or services from the merchant (2) the financier pays the merchant for the consumer’s purchase and (3) the consumer will repay the financier for their purchase overtime, staggery.78 For example, the SPay Later service appointed SeaMoney as the financier and the consumer will be indebted to SeaMoney. In the event of default, the consumers will be charged an additional 1.5%79 of the outstanding amount on a monthly basis.

Therefore, applying verse 130 of Surah Ali ‘Imran, the late payment charge is seen to have a clear element of usury as it involved interest in the transactions. In addition, with regard to the processing fee which means additional charges imposed for customers who choose the instalment plan offered by Shopee. Customers who choose to pay using the instalment plan will be charged a processing charge of 1.25% per month of the purchase amount.80 No additional charges will be levied if the customer pays one-off within a month.81 The Processing Fee imposed is seen to have an element of usury as it takes advantage of the profits from the loans granted.

As mentioned before, another possible risk for consumers is that BNPL could encourage impulse buying. Allah S.W.T. stated in al-Quran, “Eat of the fruit they bear and pay the dues at harvest, but do not waste. Surely, He does not like the wasteful”82 and “Do not spend wastefully. Indeed, the wasteful are brothers of the devils”.83 Based on these verses, Islam strictly prohibited their believers to become greedy and wasteful as Allah dislikes people who are excessive and extravagant other than these characters who resemble Satan.

According to the survey by Finder, more than a quarter (27%) of Singaporeans aged 16 and above acknowledged being worse off financially as a result of a BNPL mistake. The survey indicates that making an impulse purchase is the most common BNPL faux pas with nearly one-fifth of Singaporeans (17%) admitting doing so.84 Moreover, the World Bank Group in the 21st edition of its Malaysia Economic Monitor, which was published in 2019, expressed concern about bankruptcy among those aged 25 to 34, connoting that 60% of bankrupt debtors were in this age group. Based on the study, millennials spend well beyond their means because of impulse buying behaviour, easy access to personal loans and credit card financing, the desire for instant satisfaction and continuous online shopping85.

Hence, in applying these verses to the current situation, the protection of wealth can be achieved if the individuals control their desire in purchasing things. Other than that, one should prioritise their wealth spending especially towards family as Allah mentioned in al-Quran, “They ask, [O Muhammad], what they shall spend. Say: that which you spend for good [must go] to parents and near kindred and orphans and the needy and the wayfarer”.86 Moreover, one can spend their wealth in accordance with the hierarchy of needs which include essential needs (daruriyyat), complementary needs (hajiyyat) and embellishments needs (tahsiniyyat).

5.1.2 Dealing with current problems (maslahah)

The maqasid al-shari’ah portrays Islam as a means of improving human existence. Besides, the rules in Islam are the only way to obtain maslahah because the former can be adapted for the sake of the latter.87 It is important to mention that in Islam, maslahah is applied according to its priority.88 Scholars may come across a conflict between maslahah when dealing with specific issues. Hence, it is critical to ensure that taking account of any maslahah does not block or prevent another maslahah to be superior or equal to it.89

In fiqh muamalat, the issue of maslahah can be considered as a prominent factor to those who are involved in Islamic finance. Any action must be in line with maslahah while making a decision.90 To illustrate this argument, Islamic finance products must avoid contentious contracts such as ambiguous clauses (gharar) which will damage their legal status or locus standi. Any profit from the product may be deemed as maslahah, but it is less important in comparison to the maslahah of the image of the Islamic finance industry.

In applying this principle, the element of usury was found in the late payment charge and processing fee imposed by the BNPL provider such as SPay Later. However, if the charge is imposed to cover the cost of loss, then it is allowed provided that the cost is based on the actual cost (actual loss) as compensation (ta’widh) and is not considered as a fine (gharamah) or additional income for the financial provider company.91 Thus, this rule is actually beneficial as well as it brings maslahah to both BNPL providers and the consumers as it promotes transparency in their financial practices. If the BNPL provider can prove that they are actually incur losses due to the default payment by the consumer, hence ta’widh can be imposed to the consumer similar to what has been practised by the Islamic banks nowadays.

Nevertheless, in order to consider maslahah in actual situations, any practice which is created on maslahah or maqasid al-shari’ah must be instantly reviewed because the waqi’ is constantly changing from time to time.

5.2 Findings and Suggestions

In order to shed light for the betterment of BNPL transactions, the existing primary BNPL service providers are not shari’ah compliant as there is element of usury in the transaction. For instance, interest is charged when the consumer fails to pay on time and there is also a Processing Fee imposed on the consumer. The provider takes advantage of the profits from the loans granted. Furthermore, the consumer (borrower) and the BNPL provider through the financier (lender) do not have a proper Aqd (Islamic contract). The borrowers are given money by the lender in exchange for the products and services purchased from the merchant (BNPL providers). This transaction is asset backed, which is in accordance with of the Islamic Finance pillars, but it is non-compliant due to the lack of Aqd.92 There is also another issue of permitting individuals to purchase products that are illegal under shari’ah laws since the products are not filtered at the checkout phase.

According to an article by The Capital Markets Company (CAPCO), the authors in this paper introduced the principles for an Islamic Finance BNPL product to work in a compliant approach.93 Firstly, the consumer can register for BNPL services via an app or website. This may entail verification such as Identification Card (ID), the uploading of necessary documentation and a soft credit check to guarantee that the consumer is able to borrow funds from the service provider. This should allow the consumer to use the basic service of BNPL such as buy now, pay later in 30 days; or two split payments i.e., half today and half next month; or four instalments, either every two weeks or monthly. It is crucial to highlight the point that there would be no interest in any of the options.94 Secondly, if the consumer requests for a longer term for example six to 24 weeks, a hard credit card will be commenced, and a credit limit will be allocated to the consumer. Any purchases made within the credit limit can thereafter be converted.95

Thirdly, the consumer can go to any of the partner stores and select the BNPL payment option at checkout phase, as well as one of the other payment choices available. The BNPL provider and the consumer enter into a Murabaha agreement in which the provider finances the goods and services on a cost-plus basis. Any fees incurred as a result of the transactions can be levied under the concept of Ujrah which allows the companies to charge a fee for the services they provide.96 Fourth, the goods and services for which the payment was made are delivered to the consumer. Fifth, the amount is deducted at regular intervals (according to the plan set by the consumer during the checkout) and lastly, the penalties will be imposed for late payments. The late payment charges must be a specified fixed charge and should not have any compounding element.97 Additionally, the consumer can opt to subscribe for Takaful coverage which can cover any defaults or late payments. This means that the service can benefit every individual without putting consumers into undue debt. More importantly, the Islamic Finance BNPL product should not be about profiting money from the default payments, but rather giving consumers the freedom and power to acquire goods and services.98 Indirectly, this alternative will strengthen the relationship between the consumers and the BNPL provider since the services are introduced in a friendly manner.

Shari’ah-compliant BNPL platform

Recently in 2021, Souqa Fintech Sdn Bhd, a halal-compliant payment gateway which was established in 2018 stated that PayHalal has partnered with Atome’s Buy Now, Pay Later (iBNPL) to offer Murabaha iBNPL across the platform’s merchant touchpoints in Malaysia. The structure of Murabaha which is also known as cost-plus financing and refers to an agreement between the seller and the buyer regarding the price plus markup of an asset. In Murabaha, the concept does not bear interest unlike interest-bearing loans, because the markup interest is prohibited under Islamic law. One of the benefits of PayHalal is, the buyers will be able to split their purchases into three zero-interest deferred payments, avoiding annual or service costs.99 In addition, merchants who utilise the PayHalal platform as a payment gateway will have their products and services as halal for consumption. PayHalal acting chief executive officer (CEO), Muhammad Sulwan Mohamed Subhan said that the coronavirus pandemic has expedited Malaysian shoppers to use digital payment options as well as to improve user experience in e-commerce.100 The Islamic financial experts must examine the existing BNPL to remodel it into a shari’ah compliant BNPL. A competent shari’ah board should also be appointed in order to regulate and tackle any issue regarding BNPL.

Current development on the regulations of BNPL in Malaysia

It seems that the Buy Now Pay Later’s providers keep targeting the younger generation and also the household who have a monthly low income to keep using these platforms. The self-proclaimed ‘shariah compliant’ and abundant ‘promising’ campaigns like ‘Activate SPay Later Now and Win a Car’ from these providers somehow attracted the naive users who lack judgement and experiences especially in buying things. The users might also be unaware of the overall amount they must repay due to the lack of transparency surrounding fees and charges, particularly late payment charges and processing fees levied under these services.101

According to the Financial Stability Review by Bank Negara Malaysia (BNM), the share of BNPL users with outstanding payments in the fourth quarter of 2022 was 17%; the second quarter of 2022 was 14%; and fourth quarter of 2021 was 7%.102 It is so unfortunate that about 44% of the BNPL users are aged between 18 and 30 years old and more than 80% of them earn less than RM3,000 a month.103

Therefore, BNM is currently working to enact the Consumer Credit Act in 2022 with the goal of enhancing regulatory provisions for all consumer credit activities, including providers of BNPL services. The Federation of Malaysian Consumers Associations has long advocated for the passage of this legislation to improve consumer protection in the financial industry. The central bank will collaborate with the Ministry of Finance (MoF) and the Securities Commission (SC) to pass the Act, according to Bank Negara Malaysia governor, Datuk Nor Shamsiah Mohd Yunus. Furthermore, she commented that BNM is working with relevant authorities to keep track of changes and development of BNPL as well as to educate the public about BNPL services. The introduction of the Consumer Credit Act, which was announced in Budget 2021, aims to create a legal framework for consumer loan issuance while also improving oversight of non-bank credit providers.104

6.0 Conclusion

It is an undeniable fact that Buy Now, Pay Later is a new concept which needs to be monitored and supervised regularly under the eye of shari’ah and perhaps by the Bank Negara Malaysia in order to make sure this transaction is complementing the shari’ah. As far as Maqasid al-Shariah is concerned, specifically under the protection of wealth, it can be said that most BNPL as a payment method in Malaysia, inter alia, SPay Later, are not parallel with Islamic ruling as there is an element of usury. This transaction is not shari’ah compliant for a few reasons, among others, is interest that has been charged when a payment is missed or late payment. BNPL also does not restrict any goods or services that can be purchased where it can lead to purchasing services or goods that are tainted with forbidden elements in Islam such as obscene materials or nightclub services.

It is admitted that BNPL brings convenience and significant benefits in humans’ life especially during the pandemic of Covid-19, many people had lost their jobs, their salary had been reduced and their income was uncertain. Hence, BNPL can reduce their burden in paying their needs. Thus, Muslims can enjoy the convenience and accessibility provided without violating the law of Islam at once helping each other in hardship and attain the objective of shari’ah in protecting property. While BNPL brings benefits to humans’ life, it worth understanding that the office of Mufti suggested that Muslims are prohibited from engaging in any transaction that has an element of riba because riba is haram and a greater sin as written in the al-Quran through surah al-Baqarah verse 275, but God has allowed trade and forbidden usury105.